oklahoma franchise tax payment

Copyright 2007 Oklahoma Tax Commission Security Statement Privacy Statement Feedback OKgov Last Modified 10222007. Up to 25 cash back Also in 2018 the amount of your corporations capital allocated invested or employed in Oklahoma was 250000.

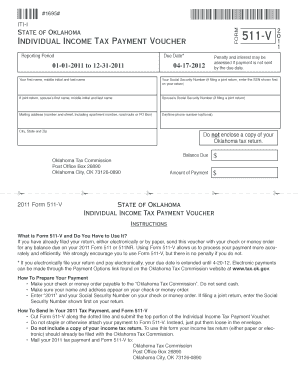

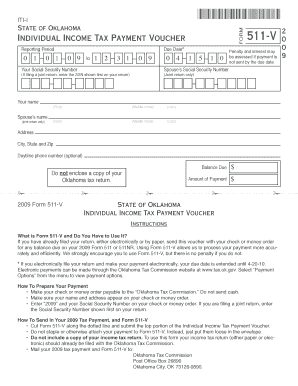

Form 511 V Oklahoma Individual Income Tax Payment Voucher

For corporations that owe.

. Oklahoma Should Prioritize Pro-Growth Relief Not Gimmicky Rebate Checks. Oklahoma Tax Commission PO Box 26890 Oklahoma City OK 73126-0890. Mine the amount of franchise tax due.

Return with your payment if applicable to. For every 1000 of investment 125 of tax is levied with a maximum limit of 20000 in a. Click the Order Cigarette Stamps link on the sidebar and complete the order form.

Not-for-profit corporations are not subject to franchise tax. Oklahoma Tax Commission Payment Center. As out-of-control inflation strains families budgets lawmakers across the country are casting.

The report and tax will be. What is the corporate tax rate in Oklahoma. Please check back later.

Your session has expired. The rate is 125 for each 1000 of capital you invest or use in Oklahoma. Time for Filing and Payment Information Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form 200-F has been filed.

Copyright 2007 Oklahoma Tax Commission Security Statement Privacy Statement. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or. And pay franchise tax.

Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax. All businesses and associations in Oklahoma are required to pay a Franchise tax. The Oklahoma Franchise Tax is a state tax levied against companies doing business within the borders of Oklahoma.

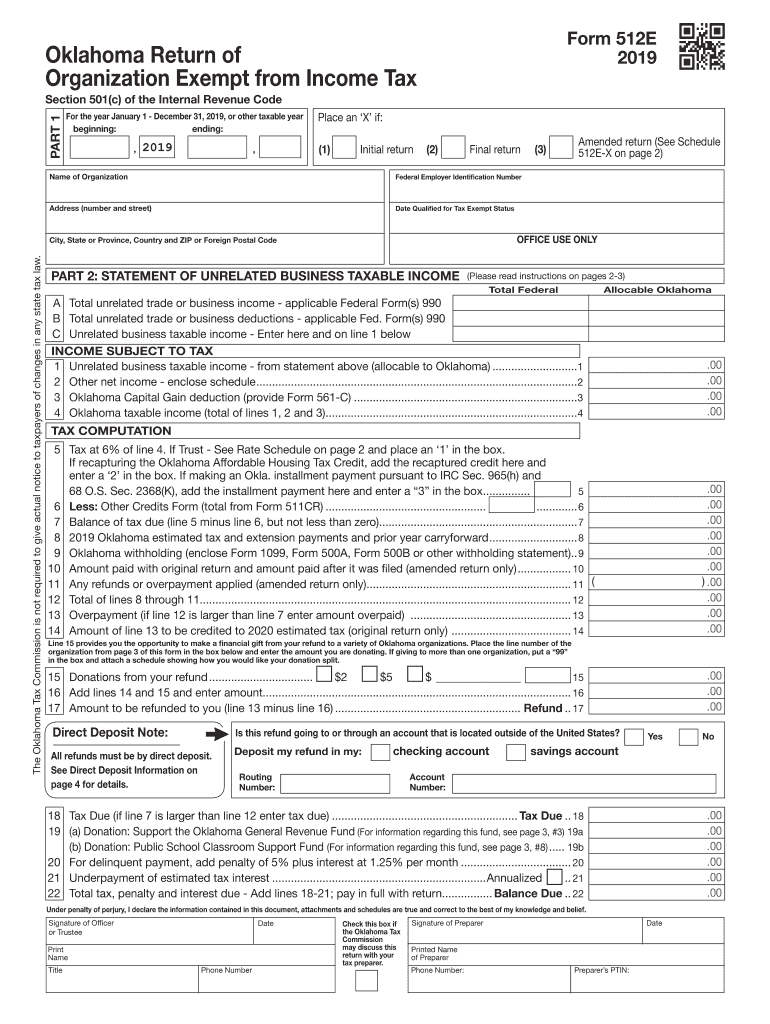

Once you have access to your Cigarette Wholesale account on OkTAP you can order stamps. Form 512 Form 513 Form 512-E. Oklahoma levies a franchise tax on all corporations or associations doing business in the state.

Companies are taxed on their total gross receipts. You will be automatically redirected to the home page or you may click below to return immediately. Oklahoma requires all corporations that do business in the state to pay a franchise tax.

With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives. Any taxpayer with an oklahoma franchise tax liability due and payable on or before july 1 2021 will be granted a waiver of any penalties andor interest for returns filed by august. Corporations are taxed 125 for each 1000 of capital invested or otherwise used.

Other things being equal the. Foreign not-for-profit corporations however are still required to pay the 10000 registered agent fee. Return to Home Page.

Oklahoma has a flat corporate income tax rate of 6000 of gross incomeThe federal corporate income tax by contrast has a marginal. Online Bill Pay is currently inactive.

Oklahoma Bill Would Eliminate Income Tax On Veterans Retirement Pay Ktul

Oklahoma Sending Cash To Companies That Pay No Income Tax

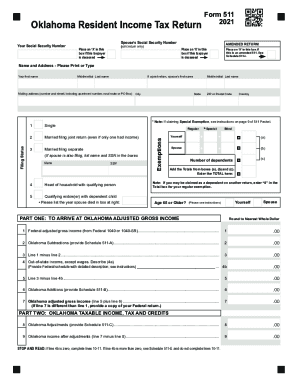

Oklahoma Tax Forms 2021 Printable State Ok 511 Form And Ok 511 Instructions

Ok After Ef Acceptance Taxpayer Receives Rejection Letter

Cherokee Chief Says No Oklahoma Income Tax For Indians Oklahoma Council Of Public Affairs

Oklahoma Tax Commission On Twitter The Oklahoma Tax Commission Has Extended The Deadline For Filing And Paying 2019 Oklahoma Income Tax Returns To July 15 Full Details At Our Covid19 Webpage Https T Co Iqr2ojvoa9

Form 511nr Oklahoma Nonresident Part Year Income Tax Return Youtube

Oklahoma Tax Relief Information Larson Tax Relief

2018 Oklahoma Return Of Organization Exempt From Income Tax Form Fill Out Sign Online Dochub

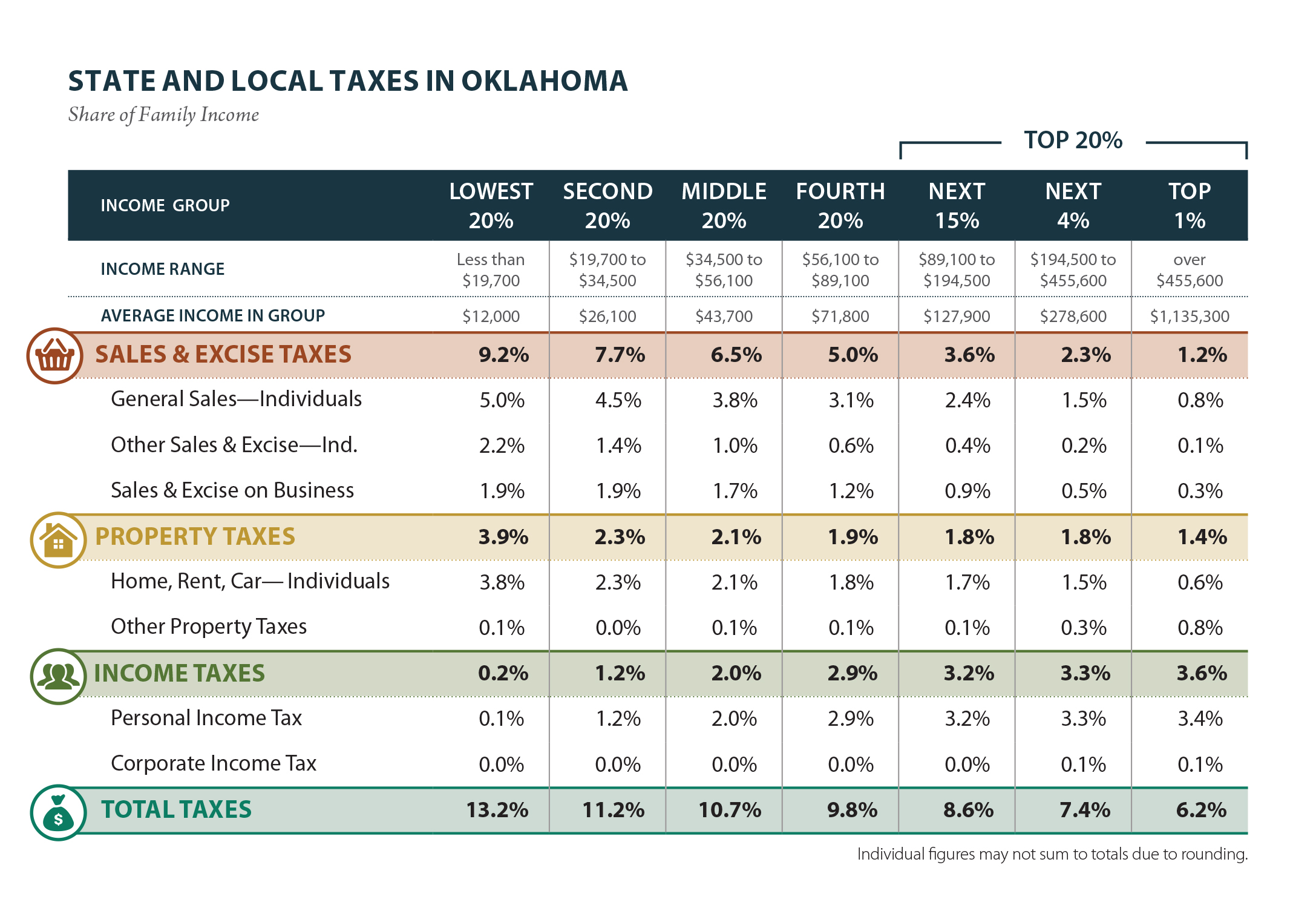

Oklahoma Who Pays 6th Edition Itep

Oklahoma Tax Commission Approves Deferred Income Tax Payments In Response To Covid 19 Pandemic Kfor Com Oklahoma City

Oklahoma Extends State Income Tax Deadline Until June 15 Local News Theadanews Com

Oklahoma Individual Income Tax Declaration For Electronic Filing Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

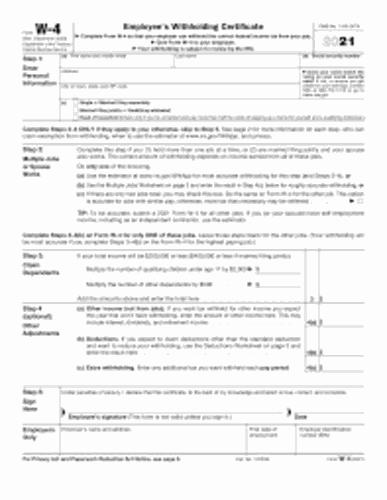

Fillable Online Tax Ok Individual Payment Voucher Form Fax Email Print Pdffiller

Fillable Oklahoma Form 511 Fill Out And Sign Printable Pdf Template Signnow

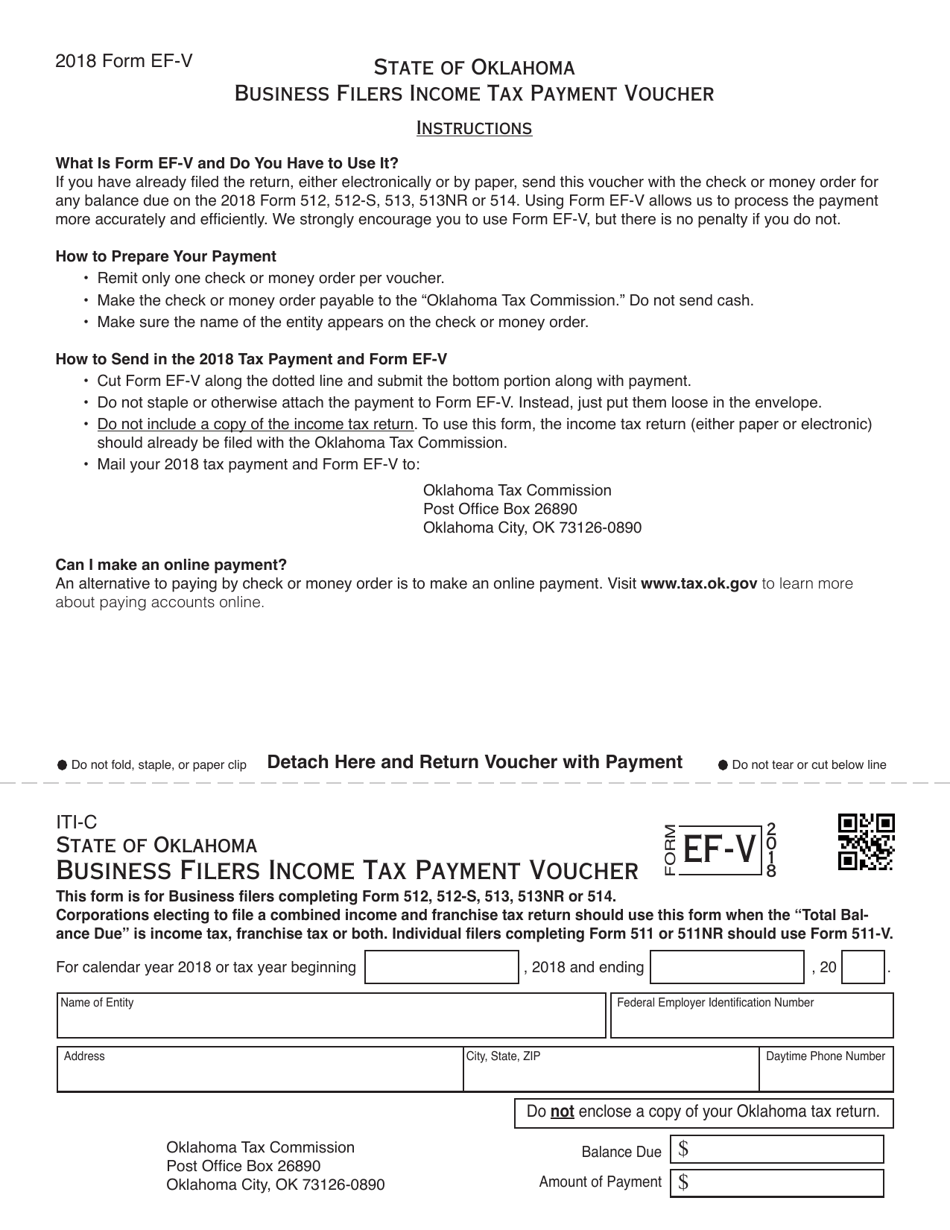

Otc Form Ef V Iti C Download Fillable Pdf Or Fill Online Business Filers Income Tax Payment Voucher 2018 Oklahoma Templateroller

State Gives Income Tax Breaks To Companies That Pay No Tax Oklahoma Watch

Fillable Online Tax Ok Printable Blank Form 511 V Ok Pay Voucher Fax Email Print Pdffiller